Table of Content

You must meet the Maximum Income Requirements for your area. The MAXIMUM income is determined per county, and is based upon how many family members reside at the residence. In the Raleigh/Cary Area the MAXIMUM income for a family with 1-4 members is $88,400 and the MAXIMUM income for a family with 5-8 members is $116,700. To find out the Maximum Income Limits for your area, click here.

USDA’s definition of rural is broad though, as it can include small towns and suburbs of major U.S. cities. In fact, 97% of U.S. land is eligible for the USDA loan program. Providing an affordable way to buy homes helps these areas build thriving communities and provide a better quality of life for rural residents. The most important thing when considering a USDA home loan is making sure the property you want to buy is eligible and located in a qualifying area of the country. In this post, we’ll explain what USDA loans are and how they work, the requirements for getting one, how to find USDA-eligible homes for sale, and the process for getting this type of loan.

WHITE CEDAR WAY HAINES CITY Florida 33844

Click one of the search types provided (Single Family Housing, Multi-Family Housing, or Farm & Ranch) to begin looking at the available properties the USDA has to offer. After selecting the search type, you will be provided with a map based search screen that will allow yo to refine your search based on geographic and/or property characteristics. The content on this site is not intended to provide legal, financial or real estate advice. It is for information purposes only, and any links provided are for the user's convenience. Please seek the services of a legal, accounting or real estate professional prior to any real estate transaction. It is not Zillow's intention to solicit or interfere with any established agency relationship you may have with a real estate professional.

This criterion is the main stipulation that the USDA uses to determine area eligibility. Most rural communities throughout the nation fall into this category. We do not independently verify the currency, completeness, accuracy, or authenticity of the data contained herein. The data may be subject to transcription and transmission errors.

What is the interest rate of your first mortgage?(It's OK to estimate)

To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. Once you find an area you want to buy a home in, you can use traditional online real estate websites to find houses for sale. When you have specific addresses picked out, enter those in the map to see if they qualify. To make the process even easier, you should consider working with a real estate agent who is knowledgeable about buying USDA-eligible homes. They will be able to guide you through the process of finding homes in a specific area that qualify for a USDA loan.

Our agency has many specialized areas, USDA home loans is our real specialty and these are also the first choice of our customers. Lauren is a Content Editor specializing in personal finance and the mortgage industry. Her writing focuses on reporting the best places to live in the U.S. based on certain interests and lifestyles. In Communications from Alma College and has worked as a writer and editor for various publications in Philadelphia, Chicago and Metro Detroit.

BURNWAY Rd HAINES CITY Florida 33844

Eligible properties can have what’s considered “income-producing” type buildings, such as a silo or barn, but they must not be used for commercial purposes. Under the USDA loan program, buyers don’t have to pay a down payment. For primary residences, the loan package entails a 30-year fixed-rate plan. To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link. This house is located in an eligible USDA property!

One important thing to note is that you can’t assume every home in an area qualifies for USDA loans. Certain towns can be split up, with some parts eligible and some not. USDA uses the U.S. census to determine eligible areas for these loans.

77th WAY Gainesville Florida 32608

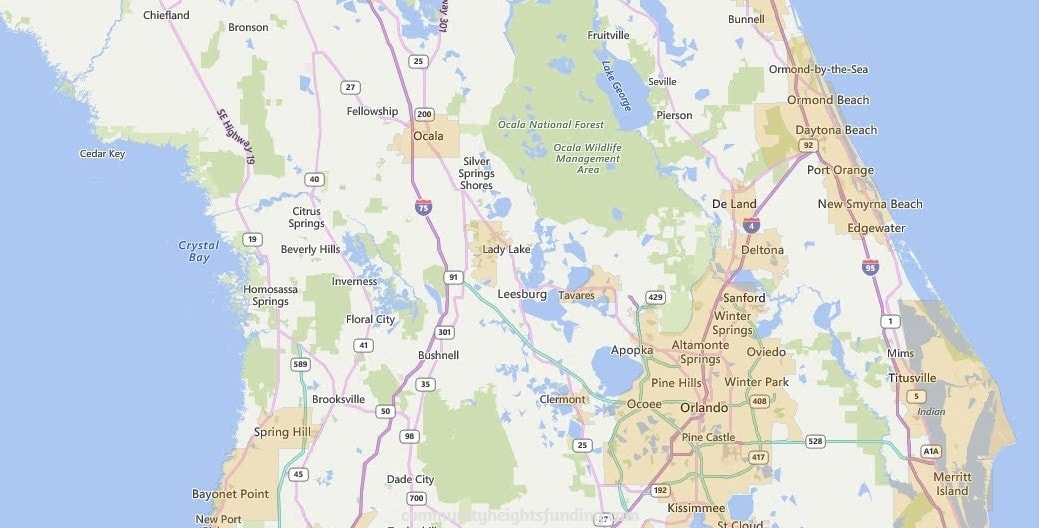

All the non peach areas in the map are in an USDA approve zone and may be eligible for a USDA home loan. This post contains links to other websites that are not hosted nor controlled by FHM. FHM is not responsible for their content, or the content of any information linked to these websites. Links to other websites are provided as a convenience to our visitors and do not imply any endorsement by FHM of information contained in these websites or the organizations that support them.

It can’t be an investment property, rental property, vacation home, or second home. Have stable and dependable income, typically for a minimum of two years. Adjusted household income needs to be equal to or less than 115% of the area median income. Your total debt payments, including your proposed mortgage payment, should not exceed 41% of your monthly income. Discover the places close to big cities that qualify for a USDA home loan. Be rest assured that agents, loan officers and their expert team will handle every detail of your transaction from start to end.

In addition to purchasing or building a home, USDA loans can be used to renovate, improve, or relocate a house in an eligible area. You can check on the USDA website if your income allows you to qualify for a USDA loan. You’ll be asked to enter the state and county where you will be purchasing a home, some details about the people that will live in your household, and your income information. Life in the country offers peace, quietness, and beauty that isn’t always found in the hustle and bustle of cities. Maybe you’ve lived in a rural town your whole life, or perhaps you’re seeking a change of pace and looking to move outside a major metropolitan location. Either way, there are some serious financial perks to buying a home in a more rural or suburban area with a loan backed by the U.S.

Some properties which appear for sale on this website may no longer be available because they are under contract, have sold or are no longer being offered for sale. Some real estate firms do not participate in IDX and their listings do not appear on this website. Some properties listed with participating firms do not appear on this website at the request of the seller.

While the UDSA property eligibility map shows a general idea of qualified locations, it's best to consult a USDA lender to ensure the location is in fact eligible. This is due to changes to what the USDA considers eligible as laws and populations change. Property eligibility areas can change annually and are based on population size and other factors. This map is a helpful guide, but the USDA will make a final determination about property eligibility once there's a complete loan application.

Accordingly, the data is provided on an ‘as is, as available’ basis only. Don't miss out on the incredible savings of up to $10, 000 being offered if you work with our preferred mortgage... Don’t miss out on the incredible savings of up to $10,000 being offered if you work with our preferred mortgage... Home is eligible for CONV, FHA, VA, USDA financing Still available at ListedBuy!

No comments:

Post a Comment